Dear readers, blogger, friends,

This is not an Academy Awards speech but just to express my gratitudes and clarifying a small issue. My sincere thanks to all for keep coming back, your moral support matters. I also want to thank blogger who makes a link to my blog despite of a very short history. As an Asian, I understand very well about reciprocal that put me in a dilemma: should I link everybody who makes a link to my blog? After I deliberated on the matter deeply, I think I owe everyone an answer.

I believe in focus. Research has shown our mind cannot handle more than seven things at one time. This is where the concept of positioning comes from. Therefore, the maximum links I have in mind are 10. This will bring maximum benefits to readers.

I believe in independent opinions. Blogging gives new meaning to democracy and freedom of speech, in a responsible way for sure. I will try to link up friends and blogger who can maintain independent minds. We enjoy rational analysis and thinking process more than just giving opinions.

This also means I will adopt no advertising policy so that I can speak with no fear.

Timeliness and relevance. An active blogger cannot be complacent, they will watch happenings around them like a hawk.

It's free. I don't expect anything in return, I hope you can be a better informed investor, exploit the same information available for big boys made available to you.

I believe in sharing knowledge with those who want to help themselves(small guys that I am referring to) - improving knowledge, mastering emotion control and money management. Those hoping to get rich quickly will be disappointed quickly, this blog and his friends have nothing to offer.

With that, let me explain why four of my friends made it to my links.

S. Dali of Malaysia Finance has an excellence independent minds, he speaks without fear. He said he has seen enough screw ups in the financial worlds. He is trying hard to help us to swim in the investing world without eaten by sharks. Watch out for some of his Black Swan warnings, he will save you a lot of troubles. I want to thank him for his tremendous faith in me, he linked me up after reading less than 10 of my entries.

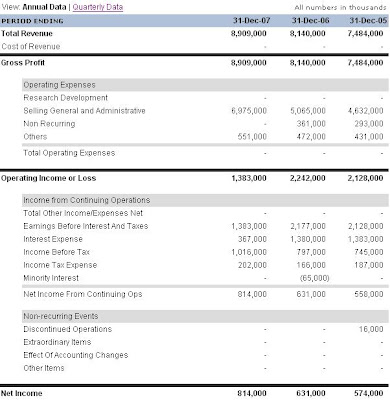

Moola has been passionate giving warnings about small companies. Many of them are not worth investigating further. But he takes the troubles to explain the obvious - those companies are not worth your time. If you look at the financial tables he produces, you can make a conclusion in less than 5 seconds, they are shitty companies - please walk away, sorry not walk, please run away.

Boon of BHC Investment. I like his work, highly sophisticated. He does his homeworks, once he reached a conclusion, he will execute regardless of what other think, even against the best. Watch what he does will give you a very good idea what is going on in commodities, currencies, debts and stock markets around the world.

Bursa Trading Ideas, a good resource blogspot. Though they don't write their own opinions, readers will be able to benefit from a diverse collection group of authors. I make an exception to include them in my link.

I am sorry for not able to include everyone. Thank you for your support.

About me: pretty much like the rest of you, a salaried man working from 8 am - 6 pm. A man hope to raise a family and accumulate enough to survive after retirement. A book worm and a self-taught investor.