Today is Malaysia's Independence Day. Independence? Yes, thank God that we are a freeman - man or woman - that has freedom to pursue our dreams. The freedom to pursue HAPPINESS.

A while back, I watched this movie of The Pursuit of Happyness, a true story inspired by a successful stock broker Chris Gardner. It is a touching story. He reminds us OUR DREAM GOT TO BE BIGGER THAN OUR BANK ACCOUNT. You got to be inspired to be best IN WHATEVER YOU ARE PURSUING.

Of many personalities that I studied, most of the successful investors, are NOT DRIVEN by MONEY but by PASSION TO BE THE BEST. I hope you will enjoy the following five highlights chosen by me. By the way, are you happy? What makes you happy? See you all on next Tuesday.

Sunday, August 31, 2008

Saturday, August 30, 2008

The US Economy Growth Mirage

From CNN Money:

The US economy has been hanging tough since the sub-prime broke out last year, partly owing to strong overseas demand for its goods. Unfortunately, high crude oil price rippled into emerging economies. High inflations threaten the original thesis of rising middle class in emerging markets as food and energy are a big chunk of their personal consumption expenditure basket. So this decoupling theory does not looking too good for now. From decoupling soon to coupling again, thanks to the excess liquidity originated from the US drove the worldwide inflation sky-high.

In the US, the initial claims stood as high as 2001 dot-com bust recessions. Without job, it will be difficult to sustain spending.

NEW YORK (CNNMoney.com) -- Despite all the talk about the U.S. economy falling on hard times this year, the economy grew at a more solid pace during the second quarter.

According to an update to the second-quarter gross domestic product report released by the government Thursday, the economy grew at a 3.3% clip, up from the 1.9% annual growth rate first reported last month. Economists surveyed by Briefing.com were expecting GDP to be revised up to 2.7% in the quarter. The GDP is the broadest measure of the nation's economic activity.

But that doesn't mean that the United States has avoided a recession, some economists say. In fact, there are growing concerns that weakness will extend through the rest of this year and even into 2009.

"My feeling is that the recession started in the fourth quarter of 2007," said David Wyss, chief economist with Standard & Poor's. "I think the worst quarter will be the first quarter of 2009, which would make it a long recession."

But many economists say temporary factors, such as the more than $90 billion in economic stimulus checks that reached taxpayers during the quarter, make the jump in the second quarter an anomaly.

Among the factors behind the likely upward revision to growth in the second quarter: more business inventories than originally estimated and improved trade figures.

The US economy has been hanging tough since the sub-prime broke out last year, partly owing to strong overseas demand for its goods. Unfortunately, high crude oil price rippled into emerging economies. High inflations threaten the original thesis of rising middle class in emerging markets as food and energy are a big chunk of their personal consumption expenditure basket. So this decoupling theory does not looking too good for now. From decoupling soon to coupling again, thanks to the excess liquidity originated from the US drove the worldwide inflation sky-high.

In the US, the initial claims stood as high as 2001 dot-com bust recessions. Without job, it will be difficult to sustain spending.

Friday, August 29, 2008

Parkson Holding Berhad, Q2 08 Review

What differentiate us from Wall Street is we don't have to live by quarter and keep revising our forecast quarterly. What we need to do is to ensure our company's intrinsic grows at reasonable rate.

Six month YoY comparisons. Profit from operations improved from 23% to 26%. Sales revenue increased by 25%, 1.8 to 2.2 billion. Profit before tax excluding gain from dilution of retail operation increased by 35%.

The management is a bit cautious about its Vietnam operations due to recent financial turbulence at the macro level.

On China operations, 1H 08 same stores sales slowed from last year's 18.4% to 14.4%. They were affected by closure of Beijing Haidan and Changsha stores and also earthquake in Sichuan.

Pace of acquisition slows down slightly.

Let's hope for better earnings growth from Sichuan stores re-open, newly acquired contributions from Tianjin and Nanjing stores and four new stores.

Have a nice weekend.

Thursday, August 28, 2008

Malayan United Industries(MUI) Q2 08 review

Not too many surprises. Profit from operations is solid, QoQ improved by almost 50%. I've been a bit worried about retail segment especially with Laura Ashley as consumers spending are expected to slow down due to housing bubble collapsed, slower economic growth and high inflation. But they are doing good. All operating units - retail, hotel, food and confectionery, financial services and travel and tourism - are profitable.

Finance cost is still a pain in the a**.

Exceptional items are caused by the provision of allowance for value diminution of quoted investment. It's something I'm not that worried as this will go up and down in line with stock market.

Will be back commenting on Parkson on Friday.

Tuesday, August 26, 2008

EC announces Anwar as winner

Tuesday August 26, 2008 MYT 10:04:34 PM

EC announces Anwar as winner

(the Star) BUKIT MERTAJAM: Datuk Seri Anwar Ibrahim has won the Permatang Pauh parliamentary seat with a majority of 15,671 votes.

The victory marks a return to Parliament for the PKR advisor after an absence of 13 years.

The Election Commission announced that Anwar polled 31,195 votes while his Barisan Nasional opponent, Datuk Arif Shah Omar Shah received 15,524.

Hanafi Hamat of Angkatan Keadilan Insan Malaysia (Akim), who contested as an independent lost his deposit, polling only 92 votes.

Anwar last won the Permatang Pauh seat in 1995 with a majority of 23,515 votes.

The by-election was held after his wife Datuk Seri Wan Azizah Wan Ismail quit as Permatang Pauh MP on July 31. She had won with a majority of 13,388 votes in the March 8 general election.

With his victory, Anwar will take over as the Parliamentary Opposition Leader.

I drove through Jalan Prai on Monday night. This is one of the roads leading to PP. I was surprised with the traffic jam at very odd hours at night. I was patient, drove slowly and finally got through the traffic discovered it was caused by people parking their cars on the road side dropped by PKR operations center. Another 50 meters or so, BN also has an operations center nearby a mosque but it was very quiet with not many people. I was thinking BN is either complacent or losing their supports. I phoned my friend told him this reminds me of Han Jang crowds prior to Mar 8,08 general election. So this news of Anwar won PP by-election is no surprise to me - losing will be a big surprise to me. A new chapter, a new milestone, Malaysia.

This will however may add more uncertainties to the market. To me this is not a big deal because the worldwide equities markets are slumping. The slump is a function of global market behaviors. Political uncertainty, no OPR rate hikes, etc are just a few of the excuses of bearish moods. While the bear is hibernating, it will be an excellent time for Malaysia to reform - for better for sure. When the global equities markets ready for a new bull run, I am confident KLCI will soar to a all time high. Mark my words.

Bond market flashes yellow and red lights

Feeling fatigue of keep reading credit crisis news for non-stop of more than 1 year but unfortunately still can't let my guard down yet. Many will argue that the Fed constantly dropping the interest rate will eventually revive the economy.

Unfortunately the real world does not agree with the simple theoretical falling interest rate leading to economy recovery. The actual credit costs are going up based on above charts. Higher lending costs unlikely to benefits consumers and businesses. Therefore, unlikely to revive the economy as fast many wish.

Why?

So, I don't think the US market can continue to rally until credit markets stabilize.

Unfortunately the real world does not agree with the simple theoretical falling interest rate leading to economy recovery. The actual credit costs are going up based on above charts. Higher lending costs unlikely to benefits consumers and businesses. Therefore, unlikely to revive the economy as fast many wish.

Why?

(WSJ)Broadly speaking, spreads lately have been at their widest since Bear Stearns was rescued in March, and in some cases at their widest in a decade.

Investors worry about widening spreads for two reasons. First, they reflect a lack of trust in the financial system -- a fear about borrowers' ability to repay. Spreads involving interbank loans suggest that banks sometimes even are nervous about lending to one another.

Second, higher spreads typically mean higher borrowing costs for businesses and consumers, potentially damaging earnings. That makes economic recovery harder. A recently released Federal Reserve survey of big banks reported that banks have "tightened their lending standards and terms on all major loan categories over the previous three months."

"We view higher spreads as a sign of stress in the financial markets, and we are worried about that," Mr. Kattar said. He and others worry that more banks, mortgage investors and brokerage firms might need government support in order to survive.

On top of that, applications from people seeking new mortgages have continued to fall, suggesting that the consumers are still pulling back.

So, I don't think the US market can continue to rally until credit markets stabilize.

Monday, August 25, 2008

Market timing or fully invested?

Research results and reality do not seem to mix well like water and oil. If you read a research like this, you will be compelled to stay fully invested. Will you go and spend your money today?

No, market timing is important but you will need to go against the crowd.

If you time the market by going against the crowd when everyone is cashing out at low valuation, you will outperform the market by 13% from the period of 1979-2002.

The tricky part is catching the bottom. Let's turn to KLCI.

In 1997/98 crisis for example, it takes 18 months to bottom out. While during dot-com bust, it takes 15 months to bottom out. For this round of bear market, it is very uncertain whether it will take 15-18 months to bottom out.

Only liar will tell you they can catch the bottom, for me, I think it will be a good entry point after 11-12 months market topped out in January 2008 and fully invested.

But if you encountered a situation of mild rally from 2002(G)-2006(H), does that means you don't invest at all?

According to a report in the AAII Journal, one of the fundamental rules for effective retirement investing is to "Avoid the temptation to time investments based on what you - or the experts - "expect" the overall market to do."

From 1986 through 1995 an investment in the S&P 500 Index would have returned 14.8% annually if it remained fully invested for the whole period. However, if you missed only the best 10 days of that period, the return would have been reduced by a third to 10.2 percent. If you missed the best 20 days out of those approximate 2,500 trading days, your return was cut in half to 7.3%.

No, market timing is important but you will need to go against the crowd.

If you take a look at the first category - Large Cap Growth - you will notice that there were 9 quarters (# of Obs.) in the past 23+ years when inflows into this Large Cap category reached extreme proportions by historical standards and the corresponding valuation factor was above its average at the same time. The Large Cap Growth style under-performed the S&P 500 over the subsequent 2 year period in 7 out of these 9 episodes which resulted in the 78% success ratio (accuracy). Moreover, the average annualized under-performance relative to the S&P 500 was 2.1% for this style. Coincidentally, there were also 9 quarters of outflows coupled with a low fundamental factor, and those signals were correct in every one of these incidents generating an average out-performance of 4.2%. Finally, the spread between the high inflow/high valuation and outflow/low valuation strategies for the Large Cap Growth style produced an average annualized out-performance of 6.3% with an 89% signal accuracy.

If you time the market by going against the crowd when everyone is cashing out at low valuation, you will outperform the market by 13% from the period of 1979-2002.

The tricky part is catching the bottom. Let's turn to KLCI.

In 1997/98 crisis for example, it takes 18 months to bottom out. While during dot-com bust, it takes 15 months to bottom out. For this round of bear market, it is very uncertain whether it will take 15-18 months to bottom out.

Only liar will tell you they can catch the bottom, for me, I think it will be a good entry point after 11-12 months market topped out in January 2008 and fully invested.

But if you encountered a situation of mild rally from 2002(G)-2006(H), does that means you don't invest at all?

Sunday, August 24, 2008

Investing vs Speculating, Hua-An Part V

This will be my final part of expounding investing vs. speculating. Many must be feeling relieved as Hua An posted a decent result despite of stock price headed lower to RM 0.54 losing about 28% based on reference price of RM 0.75/share.

What is troubling me is the gross margin deteriorated from 20% to 12% YoY. Revenue increase by 106%, from Q2 '07 210 mln to 434 mln Q2 '08 but gross profit increased by 23% only, by right should be a lot higher.

The culprit is the cost increased was not fully passed on to customers.

Many will argue that solid dividend yield of 4-5% based on 20% payout at single digit PE, must be very attractive. I will be careful not fall into dividend yield trap. Sometimes, stock price fall will wipe out dividend yield. A 20% loss in capital means, you need to wait for 5 years to recoup your capital.

The other point troubling me is the potential big fluctuation in earnings based on sensitivity study by ASEAMBankers. There could be potential more than 30% reduction in earning if there is an increase in coal price but not able to fully pass on the cost increase. If they managed to pass on the cost increase modestly, the earning enhancement is still less than 10%.

For steel related stocks, PE of 5-8 times is quite common, I will be willing to consider as an investment if the price goes down to $0.35-0.38 implying 40-50% margin of safety for high stake industry. Above that I don't think my principal safety is protected.

What is troubling me is the gross margin deteriorated from 20% to 12% YoY. Revenue increase by 106%, from Q2 '07 210 mln to 434 mln Q2 '08 but gross profit increased by 23% only, by right should be a lot higher.

The culprit is the cost increased was not fully passed on to customers.

The average prices of metallurgical coke, ammonium sulphate, crude benzene, tar oil, coal slime and middlings during the current quarter under review have increased by approximately 105%, 74%, 26%, 32%, 63% and 104% respectively compared with those of the preceding year corresponding quarter. However, the price of coal gas has reduced by approximately 16% in the current quarter compared to the same quarter last year.

Despite the seemingly favourable pricing of metallurgical coke and the majority of the byproducts as mentioned above, the price of raw materials (coking coal) has also increased quite significantly by an average of approximately 115% in the current quarter compared to the average prices registered in the preceding year corresponding quarter.

Many will argue that solid dividend yield of 4-5% based on 20% payout at single digit PE, must be very attractive. I will be careful not fall into dividend yield trap. Sometimes, stock price fall will wipe out dividend yield. A 20% loss in capital means, you need to wait for 5 years to recoup your capital.

The other point troubling me is the potential big fluctuation in earnings based on sensitivity study by ASEAMBankers. There could be potential more than 30% reduction in earning if there is an increase in coal price but not able to fully pass on the cost increase. If they managed to pass on the cost increase modestly, the earning enhancement is still less than 10%.

For steel related stocks, PE of 5-8 times is quite common, I will be willing to consider as an investment if the price goes down to $0.35-0.38 implying 40-50% margin of safety for high stake industry. Above that I don't think my principal safety is protected.

Saturday, August 23, 2008

Am I a bear now?

I'm back, after take 11/2 day off. I have been reading very little about financial news, blogs, newspaper etc this week. Not that I have turned very bearish but I had very punishing schedules and just too exhausted.

I have just came back on-line a bit more seriously an hour ago. Just got off from iCapital website. iCapital admitted that they can be wrong. The cannot be 100% right. But having a comprehensive framework is important. The question is this, if you can tell when your adviser is right or wrong, it is also implies that you are quite an expert yourself. Reversely, if you are not an expert, how can you tell your expert is wrong? If you need a hacker to catch another hacker.

My view: if you are not an expert, you should have diversified enough. Don't be intimidated by Warren Buffet when he said diversification is for bird. Yes, if we are not an expert, just admit we are a bird, so what!

Let’s take a better-managed fund like Public Small Cap with proven track record for example. Their top 5 holdings account for 25%, the rest of 75% probably distributed among 40-50 stocks. This means 1-2% of NAV for the rest.

After browsed through other funds managed by Public Mutual, their top 5 have not been exceeding 30%.

Please also read my other post on position sizing.

I have just came back on-line a bit more seriously an hour ago. Just got off from iCapital website. iCapital admitted that they can be wrong. The cannot be 100% right. But having a comprehensive framework is important. The question is this, if you can tell when your adviser is right or wrong, it is also implies that you are quite an expert yourself. Reversely, if you are not an expert, how can you tell your expert is wrong? If you need a hacker to catch another hacker.

My view: if you are not an expert, you should have diversified enough. Don't be intimidated by Warren Buffet when he said diversification is for bird. Yes, if we are not an expert, just admit we are a bird, so what!

Let’s take a better-managed fund like Public Small Cap with proven track record for example. Their top 5 holdings account for 25%, the rest of 75% probably distributed among 40-50 stocks. This means 1-2% of NAV for the rest.

After browsed through other funds managed by Public Mutual, their top 5 have not been exceeding 30%.

Please also read my other post on position sizing.

Thursday, August 21, 2008

Marc Faber's advice on asset allocation

Short follow up on my yesterday's post on insurers cutting back on equities. In his interim report to his subscribers, Marc Faber is in opinion one needs to hold a lot cash and some gold or real estate related (REIT?). Only 5% for equities, that is extremely bearish.

Got to think more about this topic -- asset allocation -- over the weekend.

Got to think more about this topic -- asset allocation -- over the weekend.

Wednesday, August 20, 2008

Insurers cutting back on stocks, moving into bonds

Insurance companies are investing in bonds and cut equities exposure. Though I want to take a contrarian view but I think I am taking a cautious view for now on all assets class. Will stick to my strategy that I publish beginning of this month -- do nothing until global market stabilizes.

(Business Times)"Overall, our allocation for the fixed income market will likely increase as we expect rates for the short to medium term to steepen, along with the expectations of higher domestic interest rates," said Kurnia Insurans Bhd's chief investment officer Pankaj Kumar.

Currently, slightly more than half of Kurnia's portfolio is in fixed income, about a quarter in cash, 12 per cent in equities and another eight per cent in real estate investment trusts.

Allianz Malaysia Bhd also follows the same strategy after reducing its position in "risky assets" to preserve capital.

As it stands, Allianz's exposure to equities is below five per cent and the balance is in fixed income. "For the second half of 2008, we will continue to accumulate fixed income at attractive yields," he said.

Although bonds are becoming more attractive, Prudential Fund Management Bhd chief investment officer Yoon Mun Thim cautions that the market is still divided over an interest rate hike.

Nonetheless, there could be a buying opportunity in the stock market over the next six months, Kurnia's Pankaj said.

Tuesday, August 19, 2008

Foreign investors unloading ahead of By-election?

My schedules have been rather very hectic recently. Knowing some of the "friends" have been coming back regularly to see what I have to say, let me make a few brief comments. Yup, by now, many are cutting their rating on Malaysia, selling Malaysian stocks.

Public Foreign goes below RM 10 this morning. Hmmmmmm.....

I was a bit puzzled with comments like political uncertainties lead to sell down. Uncertainties is not the same as unstable, right?

If Anwar wins, will he be able to solidify opposition further? With stronger opposition, more competition will it be good for Malaysian? I am not sure what policy that will frighten foreign investors. Come on, tell me your fear? Are you fear of civil war? Will civil war a high probability event? To me, LOW.

(TheEdgeDaily)KUALA LUMPUR: Shares of KNM Group Bhd fell to their lowest in 10 months yesterday, on speculation that a foreign shareholder of the company is reducing its stake due to the higher political risk in the country.

This is despite the outlook of the oil and gas process equipment manufacturer being described by fund managers as bright considering that crude oil prices are expected to be sustainable in the long run.

"One of the major shareholders is selling down. It’s a portfolio change in terms of country risk," an analyst told The Edge Financial Daily yesterday.

A fund manager said KNM’s fundamentals remain intact in the long term because oil prices are expected to be sustainable, albeit at a lower level. KNM officials declined to comment when contacted.

Yesterday, shares of KNM dropped 11% or 18 sen to finish at RM1.46 with 32.99 million shares done. The stock traded at a daily high of RM1.64 at 9am, and sank as low as RM1.38 as at 2.44pm. Shares of KNM which have declined 37.74% this year, touched a one-year high of RM2.48 on Jan 2 this year, and hit its yearly low of RM1.23 on Aug 21 2007.

Volume has also increased significantly since last Friday. A total of 15.3 million shares were traded last Friday and another 33 million traded yesterday.

Filings to Bursa Malaysia show that US-based FMR LLC, and Bermuda-registered FIL Ltd (Fidelity International Ltd) have sold down their equity interest in KNM. Both FMR and FIL had disposed of 6.55 million shares in KNM between Aug 4 and 12 this year. According to filings, Fidelity still has another 407 million shares representing 10.29% of the company

Public Foreign goes below RM 10 this morning. Hmmmmmm.....

I was a bit puzzled with comments like political uncertainties lead to sell down. Uncertainties is not the same as unstable, right?

If Anwar wins, will he be able to solidify opposition further? With stronger opposition, more competition will it be good for Malaysian? I am not sure what policy that will frighten foreign investors. Come on, tell me your fear? Are you fear of civil war? Will civil war a high probability event? To me, LOW.

Monday, August 18, 2008

The Art of Risk Control--Position Sizing. Part I

The topic I'm going to share today is a departure from value investing -- position sizing. Why position sizing you may ask? This is a very powerful risk control tool to prevent damage to your capital. This is one of the major difference between a pro and an amateur.

Assuming I have RM 10,000 capital. If I bought 2000 shares of IOI Corp at RM 4.70 cost me RM 9,400. I am committing 94% of my capital into one stock. If IOI Corp were to drop by 25%, I'm losing my capital by RM 2,350(0.25*9400). In this case I have lost 24% of my capital, left with RM 7,650 after taken the losses. I need about 31% return to get back my capital on my next investment. If I'm lucky, at 10% return per year, this will take me about 3 years to recover my principal!!!!!

Position sizing is something that many value investors do not concern too much because they think they are protected by margin of safety ( low PE, low book value, etc), they therefore think committing 94% of their capital is something that they feel comfortable and safe. They may even think the possibility of their stock to go down by 30% is unlikely. Well, you may think it is unlikely when CPO is at RM 2500/MT, how about CPO drop to RM 1,500?

There are several strategies to deal with position sizing. However, my favorite is percentage risk model. Basically, you must determine how much capital you are willing to put at risk and your stop loss percentage.

In the following example, I am willing to lose 3% of my capital with a stop loss of 25% for IOI Corp. You may construct this simple calculator in a Spreadsheet.

To lose no more than 3% of my capital with a stop loss of 25%, I am allowed to commit only RM 1,200 to buy IOI Corp or 12% of my capital. If I realize my losses, this is no big deal as I have lost only RM 300. I still have RM 9,700 of my principal, with 10% per annum return, it will only take me only about 3 months to recover my principal.

Can you see the difference?

Now you may ask me why am I committing such a big position on my MUI and Parkson? When I started with such small position, it is inevitable that I'm exposing myself to take a lot more risks. When I took at that size, I'm taking into consideration of my future cash flow, with RM $ 888/month, I know I am going to have about RM 10,000 in the first year, I'm using this forward capital in my sizing consideration. With RM 2,500 per position or investment idea, I am exposing myself a potential 6% losses on my capital on 25% stop-loss. I think I can live with that based on the size of my stomach since this is still less than 10% -- but I think my risk management should be OK.

If you want to learn more about position sizing, Trader Mike wrote an excellence piece on this topic, you may visit http://tradermike.net/2005/07/position_sizing/

Good luck.

Assuming I have RM 10,000 capital. If I bought 2000 shares of IOI Corp at RM 4.70 cost me RM 9,400. I am committing 94% of my capital into one stock. If IOI Corp were to drop by 25%, I'm losing my capital by RM 2,350(0.25*9400). In this case I have lost 24% of my capital, left with RM 7,650 after taken the losses. I need about 31% return to get back my capital on my next investment. If I'm lucky, at 10% return per year, this will take me about 3 years to recover my principal!!!!!

Position sizing is something that many value investors do not concern too much because they think they are protected by margin of safety ( low PE, low book value, etc), they therefore think committing 94% of their capital is something that they feel comfortable and safe. They may even think the possibility of their stock to go down by 30% is unlikely. Well, you may think it is unlikely when CPO is at RM 2500/MT, how about CPO drop to RM 1,500?

There are several strategies to deal with position sizing. However, my favorite is percentage risk model. Basically, you must determine how much capital you are willing to put at risk and your stop loss percentage.

In the following example, I am willing to lose 3% of my capital with a stop loss of 25% for IOI Corp. You may construct this simple calculator in a Spreadsheet.

To lose no more than 3% of my capital with a stop loss of 25%, I am allowed to commit only RM 1,200 to buy IOI Corp or 12% of my capital. If I realize my losses, this is no big deal as I have lost only RM 300. I still have RM 9,700 of my principal, with 10% per annum return, it will only take me only about 3 months to recover my principal.

Can you see the difference?

Now you may ask me why am I committing such a big position on my MUI and Parkson? When I started with such small position, it is inevitable that I'm exposing myself to take a lot more risks. When I took at that size, I'm taking into consideration of my future cash flow, with RM $ 888/month, I know I am going to have about RM 10,000 in the first year, I'm using this forward capital in my sizing consideration. With RM 2,500 per position or investment idea, I am exposing myself a potential 6% losses on my capital on 25% stop-loss. I think I can live with that based on the size of my stomach since this is still less than 10% -- but I think my risk management should be OK.

If you want to learn more about position sizing, Trader Mike wrote an excellence piece on this topic, you may visit http://tradermike.net/2005/07/position_sizing/

Good luck.

Saturday, August 16, 2008

Buffett, Soros out of touch?

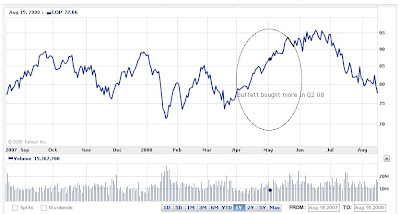

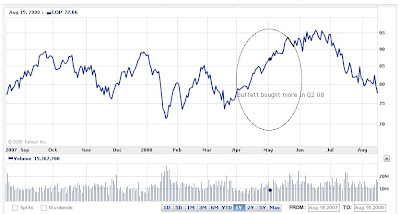

I must say those bought commodities in 2003 are genuinely having good foresight. Jim Rogers, this award goes to you. Those still bought commodities in 2006 are quite shrewd as they managed to spot on the trend of rising commodities. I am a bit unsure of those who joined the party in the late of 2007 or early 2008. Did they spotted the longterm fundamental but wrong on timing? Both Buffett and Soros added energy stocks at the peak--before the violent correction set in.

It is a little bit unusual to me that Buffett bought at all the time high or he simply think this is not a bubble and just a temporary peak and the bull will continue to run?

http://www.businesstimes.com.sg/sub/news/story/0,4574,292579,00.html?

When George Soros came out of his retirement to ensure that his wealth is not destroyed by the deleveraging environment. I was at first suspected that he is out of touch. However, he is actually doing quite all right as he broke even last year -- shorts on the US market paid off but gains offset by his emerging markets bets. However, again, buying energy at all time high is unusual to me. What is shocking he has been saying this is a bubble yet he stepped in? Why?????

http://www.bloomberg.com/apps/news?pid=20601086&sid=aLW16QIlRoWI&refer=latin_america

Jim Rogers. He is absolutely bullish about commodities. However, having watching him, you need to be careful as he likes to buy when everybody absolutely hate it. However, when he is bullish, it does not mean an outright buy. Let me give you an example, he was bullish on Taiwan market at the beginning of the year -- BUT -- he did not buy Taiwan market yet. You will absolutely got excited with his bullishness when watching him appearing on TV. Guess what, Taiwan Index falls by almost 20 plus percent and now he said he is watching for the right time to enter. I suspect his buy trigger will be ON when Shanghai Index falls to around 2,000 points or less.

He has been absolutely positive saying he does not like to buy oil at all time high for a while ( a year may be??) What is more interestingly, he came up to CNBC said he is buying airlines which indicating oil will fall -- 50% off???.

Boone Pickens bets crude oil will not drop below $100.

Another contrarian, Marc Faber has been telling his newsletter readers to buy airlines since beginning of July betting crude oil will fall. Well, crude oil fall it did.

I am taking Marc's view for now, when the bulls and bears are fighting, just don't stand in the the middle of the fight. Additionally, we are in a deleveraging environment. Just wait-and-see.

It is a little bit unusual to me that Buffett bought at all the time high or he simply think this is not a bubble and just a temporary peak and the bull will continue to run?

(Reuters--NEW YORK) Billionaire Warren Buffett's Berkshire Hathaway Inc took a stake in NRG Energy Inc, the second-biggest power producer in Texas. Mr Buffett also made an undisclosed transaction involving ConocoPhillips, the second-largest US refiner.

Berkshire had 3.24 million NRG shares as at June 30, the Omaha, Nebraska-based company said on Thursday in a regulatory filing disclosing equity investments at the end of the second quarter.

'It would be logical for him to increase his utility and energy holdings and NRG would fit in nicely,' said Frank Betz, a partner at Warren, New Jersey-based Carret Zane Capital Management, which oversees US$800 million, including Berkshire shares.

'There's exponentially increasing demand for energy and power.' Mr Buffett, ranked the world's richest man by Forbes magazine, built Berkshire from a failing textile manufacturer by investing premiums from insurance subsidiaries such as Geico Corp in out- of-favour securities and buying businesses whose prospects and management he deemed superior. Berkshire spent US$3.98 billion on stocks in the quarter, more than twice the investment from the previous three months, separate filings show.

http://www.businesstimes.com.sg/sub/news/story/0,4574,292579,00.html?

When George Soros came out of his retirement to ensure that his wealth is not destroyed by the deleveraging environment. I was at first suspected that he is out of touch. However, he is actually doing quite all right as he broke even last year -- shorts on the US market paid off but gains offset by his emerging markets bets. However, again, buying energy at all time high is unusual to me. What is shocking he has been saying this is a bubble yet he stepped in? Why?????

Aug. 15 (Bloomberg) -- Billionaire investor George Soros bought an $811 million stake in Petroleo Brasileiro SA in the second quarter, making the Brazilian state-controlled oil company his investment fund's largest holding.

As of June 30, the stake in Petrobras, as the Rio de Janeiro-based oil producer is known, made up 22 percent of the $3.68 billion of stocks and American depositary receipts held by Soros Fund Management LLC, according to a filing with the U.S. Securities and Exchange Commission. Petrobras has since slumped 28 percent.

http://www.bloomberg.com/apps/news?pid=20601086&sid=aLW16QIlRoWI&refer=latin_america

Jim Rogers. He is absolutely bullish about commodities. However, having watching him, you need to be careful as he likes to buy when everybody absolutely hate it. However, when he is bullish, it does not mean an outright buy. Let me give you an example, he was bullish on Taiwan market at the beginning of the year -- BUT -- he did not buy Taiwan market yet. You will absolutely got excited with his bullishness when watching him appearing on TV. Guess what, Taiwan Index falls by almost 20 plus percent and now he said he is watching for the right time to enter. I suspect his buy trigger will be ON when Shanghai Index falls to around 2,000 points or less.

He has been absolutely positive saying he does not like to buy oil at all time high for a while ( a year may be??) What is more interestingly, he came up to CNBC said he is buying airlines which indicating oil will fall -- 50% off???.

Boone Pickens bets crude oil will not drop below $100.

"I don't think it'll drop below $100," Pickens told Reuters in a telephone interview. "I would say $110 is where it might go, something like that."

Another contrarian, Marc Faber has been telling his newsletter readers to buy airlines since beginning of July betting crude oil will fall. Well, crude oil fall it did.

"Prices have made a peak,'' said investor Marc Faber, who publishes the Gloom, Boom & Doom Report.

"Whether that is a final peak or an intermediate peak followed by higher prices, we don't know yet. It could go lower,'' he said by phone today from Chiang Mai, Thailand.

I am taking Marc's view for now, when the bulls and bears are fighting, just don't stand in the the middle of the fight. Additionally, we are in a deleveraging environment. Just wait-and-see.

Friday, August 15, 2008

Expert: Financial data shows outflow of hot money in July

More reports on hot money leaving China supporting my view of steeper China stock market fall related to unwinding of hot money. I hope the Chinese stock market to hit bottom soon to remove the overhang for Hong Kong market and others Chinese stocks.

If Ringgit is moving in a lock-step with Yuan, this will have psychological impact on Ringgit in the short-term. I post the whole article here for future reference.

If Ringgit is moving in a lock-step with Yuan, this will have psychological impact on Ringgit in the short-term. I post the whole article here for future reference.

(Xinhua)Chinese mainland banks received $5.6 billion in foreign exchange deposits in July, compared with $11.9 billion the month previous, according to the People's Bank of China data released on Wednesday.

Liu Yuhui, head of the Chinese economy evaluation center under the Chinese Academy of Social Sciences, said on Thursday forex deposits were less than the $8.336 billion foreign direct investment (FDI) actually used nationwide and the $25.28 billion trade surplus in July. The gap and the monthly decline pointed to an obvious outflow of short-term speculative funds, or hot money, he noted.

The outflow was partly due to the strengthening US dollar over the past couple weeks, he added.

"Large amounts of capital have been flowing back to the United States because of the stronger dollar. The process began at the beginning of the year in India and the Republic of Korea, but in June and July in China."

The short-term upward adjustment of the dollar resulted partly from the downward movement of crude oil prices on international markets over the past few weeks, said Zhao Xijun, deputy head of the research institute of finance and securities under the Renmin University in Beijing.

China has been on high alert against a quick outflow of hot money in quantity in a short period, something which will affect the country's economy adversely.

In a related development, central bank data showed the outstanding amount of broad money supply, or M2, which covers cash in circulation plus all deposits, stood at 4.46 trillion yuan ($650.1 billion) through July, a growth of 16.35 percent over the same period last year. The outstanding amount of narrow money supply, or M1, which covers cash in circulation plus corporate current deposits, was 1.55 trillion yuan, up 13.96 percent.

The growth rates for M2 and M1 were 0.39 percentage points and 7.09 percentage points, respectively, lower than the 2007 year-end level.

The slowdown indicated the ongoing tightening monetary policy added to pressure on enterprises in funds, Liu believed.

But Cao Honghui of the research institute of finance under the Chinese Academy of Social Sciences said the effective control on money supply growth was conducive to curbing inflation in a continuous way.

Through July, the outstanding amount of savings deposits was 4.553 trillion yuan nationwide, up 18.79 percent year-on-year. The savings deposits have kept increasing since the beginning of this year, said Li Huiyong, a macro-economic analyst with Shenyin-Wanguo Securities, who estimated the growth in such accounts at about 16 percent for July, up 1.3 percentage points from June.

Li attributed the quicker capital flow to savings accounts to shrinking returns on investment in stocks and real estate.

Thursday, August 14, 2008

China's retail rise fastest since 1999

A bit of good news continue to support my conviction on domestic consumption willl continue to offset trade weakness in China.

Aug. 13 (Bloomberg) -- China's retail sales expanded at the fastest pace in at least nine years in July as incomes and prices climbed in the world's fastest-growing major economy.

Sales rose 23.3 percent to 862.9 billion yuan ($126 billion) after gaining 23 percent in June, the statistics bureau said today. That was more than the 22.4 percent median estimate of 19 economists surveyed by Bloomberg News.

Urban disposable incomes increased 14.4 percent in the first half, or 6.3 percent after stripping out inflation. China aims to increase consumption to reduce dependence on investment and overseas sales for economic growth.

``Domestic consumption is likely to be the most stable growth engine for the economy for the rest of the year,'' said Michael Dai, senior economist at Bank of China (Hong Kong) Ltd. ``I'd be more worried about the trade sector.''

While economic growth has slowed for four straight quarters, the 10.1 percent expansion in the three months through June was still the fastest of the world's 20 biggest economies. Gross domestic product growth below 9 percent would be ``unacceptable'' for a government targeting 10 million new jobs a year, according to a Credit Suisse Group report this month.

Ringgit Depreciation, an over-reaction?

Just a little bit of Ringgit depreciation cause many to react. Analysts make comments as if Ringgit is going to continue to depreciate against US $ with no U-turn. Now they are calling those with exposure to US $ revenue to be atractive and those with US $ cost exposure to be unfavorable.

One needs to clear their minds not to over react to news on the newspaper. These guys will make comments to create volatility to prop up trading fees or have no idea of what they are talking about. Intellignet but lack of insight. I believe US $ rally is a bear market rally, most have just started to reduce exposure of Euros and probably shifting a bit back to US $. The rests are just noise, some of commodities like gold and Asian currencies get into sympathy selling. The market is trying to find a new balance. I still believe Ringgit worth RM 2.90 to 1 USD despite of confidence is wobbling. Bank Negara spent a few billions to facilitate the foreign funds retreat in an orderly manners. Long term trend of Ringgit is UP unless our government is stupid enough to run big budget deficits. By the end of the day, it is the rule of relativity wins -- I believe Asia will suffer the least damage from the slowdown.

One needs to clear their minds not to over react to news on the newspaper. These guys will make comments to create volatility to prop up trading fees or have no idea of what they are talking about. Intellignet but lack of insight. I believe US $ rally is a bear market rally, most have just started to reduce exposure of Euros and probably shifting a bit back to US $. The rests are just noise, some of commodities like gold and Asian currencies get into sympathy selling. The market is trying to find a new balance. I still believe Ringgit worth RM 2.90 to 1 USD despite of confidence is wobbling. Bank Negara spent a few billions to facilitate the foreign funds retreat in an orderly manners. Long term trend of Ringgit is UP unless our government is stupid enough to run big budget deficits. By the end of the day, it is the rule of relativity wins -- I believe Asia will suffer the least damage from the slowdown.

(13 Aug TheEdgeDaily)The local currency continued its downward trend for an eighth straight day yesterday, hitting the year’s low at 3.3350 to the US dollar. It closed at 3.3250 to the greenback as at 5pm, against 3.3160 on Monday.

The ringgit’s weak performance has largely been attributed to the US dollar’s gains against major currencies. Analysts also expected slower exports to result in further declines in the ringgit.

Speaking to The Edge Financial Daily, Aseambankers Malaysia Bhd head of research, Vincent Khoo, said the weakened ringgit would be favourable towards plantation companies, such as Sime Darby Bhd, which had seen a downtrend in crude palm oil prices.

Other beneficiaries of the ringgit decline included companies with exposure overseas, especially those in the oil and gas sector, Khoo said. “A counter that comes to mind is KNM Group Bhd which has businesses contracted in US dollars,” he said.

He added the current environment could warrant a review of the research house’s outlook for the ringgit which was originally expected to significantly appreciate against the US dollar.

Jupiter Securities Sdn Bhd head of research, Pong Teng Siew, also said the fall of the ringgit would be an advantage to exporters and plantation companies, although the benefits would not be very clear-cut due to the current inflation spell.

“At a basic level, exporters would benefit from the ringgit decline but not by very much as margins are already thin due to inflation,” Pong said. “Even if goods (sold) are cheaper, overseas demand is lower as a result of a slowdown in the European Union, China, and the US. So, the weaker ringgit may not help improve volume significantly.”

He said the setback in the local currency would, however, paint a slightly better picture for the palm oil sector as it helped to stabilise the declining price of the commodity.

On the outlook for the ringgit, Pong said its decline could last for the most of the current quarter, with its value expected to weaken further to around 3.40 to the US dollar.

Wednesday, August 13, 2008

Is Value Investing relevant? Part II

Those of you believe you should hang on to shares with single digit PE with hope of margin of safety will be dissapointed. Goldman Sachs sells 4.7 million of SAAG shares when it has single digit PE.

I believe value investing is still relevant but we can't pretend we are all right when the value of our investment goes down ridiculously. The important areas will be position sizing and timing which I need to spend time reflecting.

(The Star) KUALA LUMPUR: Goldman Sachs International disposed of 4.76 million shares of SAAG Consolidated from July 29-31, when the share price was trading near five-month highs.

A filing to Bursa Malaysia showed that it disposed of two million shares on July 29 and 2.16 million shares the next day. It sold 600,000 shares on July 31.

At the current share price of 46 sen, it was trading at price to earnings of 8.14 times.

I believe value investing is still relevant but we can't pretend we are all right when the value of our investment goes down ridiculously. The important areas will be position sizing and timing which I need to spend time reflecting.

China's CPI rise 6.3% but PPI rise 10%

China's CPI is receeding to 6.3% but PPI come in at 10%. The market did not like it and contnued to sell, the excuse was higher PPI means cost increased was not pass on to consumers thus hurting corporate profits. Shanghai Composite Index closed at 2,457today. Is it true? No, it has to do with unwinding of speculative funds. I think the market is trying to find all kind of excuse to let the market to fall to 2,000 points, 18% more to go.

Fundamentally, nothing has changed. Sentiments have changed. Most people think post- Olympic will be a disaster. Think about this. Many of the factories, KTV, hotel, street vendors, "copy stuffs" were closed during Olympic. These efforts started since early July, I won't be surprise the main stream media will continue to amplify the fear of demand collapse. As soon as all the foreigners leave China by mid September, the factory of the world will churn out products again. The worst should be pre and not post.....8-9% GDP? On-track!

So-called "B-shares," which are denominated in U.S. dollars and take up only a small segment of market volume, fell sharply in Shanghai, dropping 9% and helping to pull the composite index lower.

Stricter foreign exchange controls and a strengthening of the U.S. dollar against the Chinese yuan could be leading speculative investors to pull out investments that had been targeting gains in the local currency, said Zhang Linchang, a strategist at Guotai Junan Securities in Shanghai.

Fundamentally, nothing has changed. Sentiments have changed. Most people think post- Olympic will be a disaster. Think about this. Many of the factories, KTV, hotel, street vendors, "copy stuffs" were closed during Olympic. These efforts started since early July, I won't be surprise the main stream media will continue to amplify the fear of demand collapse. As soon as all the foreigners leave China by mid September, the factory of the world will churn out products again. The worst should be pre and not post.....8-9% GDP? On-track!

Tuesday, August 12, 2008

Is Value Investing Relevant?

In the past, value investors seldom lost their shirts as they normally pretty protected by margin of safety. This time around, value investors had very dismal performance.

Honestly speaking, I have not seen this in my investing experience. You lose money in every sector even though they are cheap. They are just keeping cheaper by day. Those like to take big bet will suffer. Even our Omaha got whack. Those buy into Berkshire hoping to find refuge will be dissapointed as well.

I guess the best thing to do now is keep spending time study company. When the wind change, we will be ready to roar.

Aug. 11 (Bloomberg) -- Bill Miller, Martin Whitman and David Dreman, mired in the worst slumps of their careers, are poised once again to trounce the stock market.

If history is any guide, the value investors' emphasis on shares trading at low prices relative to cash flow and earnings will provide returns superior to the holdings of so-called growth managers. Growth investing, which focuses on companies with the fastest projected profit increases, beat value strategies for the first time this decade in 2007 and by 15.5 percentage points so far this year, the widest margin since 1980, according to data compiled by Paris-based Societe Generale SA.

The five prior times since 1952 that growth beat value two years in a row, the latter group recovered and won by 17 percentage points annually on average for seven years, the data from Societe Generale show. Cheap stocks are becoming more attractive because of tumbling commodity shares, which had led the five-year bull market that ended in October, according to Societe Generale's James Montier, voted top global strategist in Thomson Extel's survey since 2005.

Value stocks became a liability as even Warren Buffett's Berkshire Hathaway Inc., the investment vehicle for the richest person in Forbes magazine's 2008 global tally, fell as much as 25 percent from a December record. Miller's Legg Mason Value Trust, which beat the Standard & Poor's 500 Index for 15 years through 2005, lost 27 percent including dividends this year, Bloomberg data show.

Honestly speaking, I have not seen this in my investing experience. You lose money in every sector even though they are cheap. They are just keeping cheaper by day. Those like to take big bet will suffer. Even our Omaha got whack. Those buy into Berkshire hoping to find refuge will be dissapointed as well.

Berkshire declined this year as Buffett lost money from his stakes in Charlotte, North Carolina-based Bank of America Corp., the biggest U.S. lender by market value, and New York-based American Express Co., the nation's largest credit-card company by purchases. The stocks declined 22 percent and 27 percent, respectively. Buffett, 77, couldn't be reached for comment.

Berkshire posted its third straight quarterly profit decline last week as lower rates pressured results from insurance.

I guess the best thing to do now is keep spending time study company. When the wind change, we will be ready to roar.

Monday, August 11, 2008

The Art of Selling, Part II

There are many strategies to cash out. Let’s start from a few popular strategies before gets to my favorite.

(i) Exit based on profit target. They will exit when it hit certain % of profit. Buy RCE at RM 0.50 and cash out at RM 0.60, a 20% profit. Straight-forward and clean.

(ii) Exit based on moving average or band or any other technical indicator. Sell when it move below 60-day-moving average for example.

(iii) Sell when fully valued. Some will assign Fair Value to a stock, let’s say Genting has a Fair Value of RM $ 9.00. Once the stock price hit RM $ 9.00, the investor will automatically cash out and reinvest in other stocks below Fair Value or wait for Genting to pull back significantly – say RM 6.30 again(30% discount from Fair Value).

(iv) Exit based on index target. A group of stocks, especially index-linked, will generally move in tandem with an index. An index is generally reflecting the investors’ sentiments. Let’s say Public Bank is selling at RM 10.00 when KLCI index is around 1150. 1150 reflects poor sentiments. When KLCI moves by 15% to 1322, Public Bank may move by 12% to RM 11.20. At 1322, some may feel that the sentiments are not strong enough and KLCI may pull back to 1200, an investor may opt to cash out Public Bank at RM 11.20 even though it has not reach its Fair Value ( RM 13 for example) and wait for a lower price again.

More advanced players may look at beta to set their exit point.

(v) No Exit. Warren Buffet said he has no exit strategy as he will buy and hold forever. I’ve written in my previous entry this is not true as he did exit based on this outlook for a business. He will leave his portfolio alone as long as the intrinsic value of the business is growing at satisfactory rates regardless of the performance of share price. He may think American Express intrinsic value is doing fine even though the share price is doing very poorly, shed of 30-40% market capitalization due to recession fear and credit crunch.

(vi) Exit once a sector is no longer in favor. Since commodity is correcting and it could take a long time for investors to unwind their positions. Most of the stocks in the sector will have stigma problem despite of selling very cheap. Petronas Dagangan may be a retail stock selling for a single digit forward-PE but most may perceive it as Oil and Gas stock -- the share price will be whacked if crude oil price were to go down further. Some may opt to get out despite of cheap valuation to avoid sympathy selling.

(vii) Exit based on gut feel or “flexible”. Research has shown this is one of the worst strategies. An investor may be rationalizing why they should not cash out considering the past performance, going against the grain ( contrarian ), one of your best performance stocks, (pride, ego, etc). AIG is one of the oldest insurance companies around, however they did so badly due to sector melt down – it may bounce back but could be years from now no matter how deep is your love for the stock.

(viii) One of my favorites is Trailing-Stops. Trailing-Stops is a strategy to cash out after you have set at certain % pull back from the top. I usually combined valuation in setting my Trailing-Stops.

If a stock has been running for a long time, more than 5 years and valuation reach at sky-high, selling for 30-40 times PE for example, I will set a 25% Trailing-Stop. Let’s say Public Bank is selling at 40 times PE at RM 27 today, a pull back to RM 20 will trigger me to cash out. Some may argue that you should have sold RM 27, well it is entirely up to you. In super-bull run, valuation may reach 100 times PE or RM 67, it is entirely up-to your risk-reward appetite.

Trailing-Stop % pull back is a very personal one. Personally, I will not set less than 20% because less than 20% is consider as a minor correction and has potential of moving higher. However, it very likely when a stock fall more than 20% to fall into bearish territory and has potential to fall further, at 25% will be a good confirmation of the bull is severely wounded. It will take a while before it can climb back – no matter how strong are the fundamentals.

Back to strong fundamental stocks, we can always re-enter a position when significant excesses have been worked out. Back to crude oil example, in 2006, we can exit when it hit US $ 60 per barrel after reached US $ 80 per barrel and re-enter again around US $ 50 per barrel again.

In the latest correction, the trailing-stop should be around $ 110 ( 75% of US $ 147), most have a target of around US $ 100, I think when it overshoot by 20% from US $ 100 target, it may pull back to US $ 80 per barrel, you may re-enter again to ride on the long-term fundamental story of crude oil.

(i) Exit based on profit target. They will exit when it hit certain % of profit. Buy RCE at RM 0.50 and cash out at RM 0.60, a 20% profit. Straight-forward and clean.

(ii) Exit based on moving average or band or any other technical indicator. Sell when it move below 60-day-moving average for example.

(iii) Sell when fully valued. Some will assign Fair Value to a stock, let’s say Genting has a Fair Value of RM $ 9.00. Once the stock price hit RM $ 9.00, the investor will automatically cash out and reinvest in other stocks below Fair Value or wait for Genting to pull back significantly – say RM 6.30 again(30% discount from Fair Value).

(iv) Exit based on index target. A group of stocks, especially index-linked, will generally move in tandem with an index. An index is generally reflecting the investors’ sentiments. Let’s say Public Bank is selling at RM 10.00 when KLCI index is around 1150. 1150 reflects poor sentiments. When KLCI moves by 15% to 1322, Public Bank may move by 12% to RM 11.20. At 1322, some may feel that the sentiments are not strong enough and KLCI may pull back to 1200, an investor may opt to cash out Public Bank at RM 11.20 even though it has not reach its Fair Value ( RM 13 for example) and wait for a lower price again.

More advanced players may look at beta to set their exit point.

(v) No Exit. Warren Buffet said he has no exit strategy as he will buy and hold forever. I’ve written in my previous entry this is not true as he did exit based on this outlook for a business. He will leave his portfolio alone as long as the intrinsic value of the business is growing at satisfactory rates regardless of the performance of share price. He may think American Express intrinsic value is doing fine even though the share price is doing very poorly, shed of 30-40% market capitalization due to recession fear and credit crunch.

(vi) Exit once a sector is no longer in favor. Since commodity is correcting and it could take a long time for investors to unwind their positions. Most of the stocks in the sector will have stigma problem despite of selling very cheap. Petronas Dagangan may be a retail stock selling for a single digit forward-PE but most may perceive it as Oil and Gas stock -- the share price will be whacked if crude oil price were to go down further. Some may opt to get out despite of cheap valuation to avoid sympathy selling.

(vii) Exit based on gut feel or “flexible”. Research has shown this is one of the worst strategies. An investor may be rationalizing why they should not cash out considering the past performance, going against the grain ( contrarian ), one of your best performance stocks, (pride, ego, etc). AIG is one of the oldest insurance companies around, however they did so badly due to sector melt down – it may bounce back but could be years from now no matter how deep is your love for the stock.

(viii) One of my favorites is Trailing-Stops. Trailing-Stops is a strategy to cash out after you have set at certain % pull back from the top. I usually combined valuation in setting my Trailing-Stops.

If a stock has been running for a long time, more than 5 years and valuation reach at sky-high, selling for 30-40 times PE for example, I will set a 25% Trailing-Stop. Let’s say Public Bank is selling at 40 times PE at RM 27 today, a pull back to RM 20 will trigger me to cash out. Some may argue that you should have sold RM 27, well it is entirely up to you. In super-bull run, valuation may reach 100 times PE or RM 67, it is entirely up-to your risk-reward appetite.

Trailing-Stop % pull back is a very personal one. Personally, I will not set less than 20% because less than 20% is consider as a minor correction and has potential of moving higher. However, it very likely when a stock fall more than 20% to fall into bearish territory and has potential to fall further, at 25% will be a good confirmation of the bull is severely wounded. It will take a while before it can climb back – no matter how strong are the fundamentals.

Back to strong fundamental stocks, we can always re-enter a position when significant excesses have been worked out. Back to crude oil example, in 2006, we can exit when it hit US $ 60 per barrel after reached US $ 80 per barrel and re-enter again around US $ 50 per barrel again.

In the latest correction, the trailing-stop should be around $ 110 ( 75% of US $ 147), most have a target of around US $ 100, I think when it overshoot by 20% from US $ 100 target, it may pull back to US $ 80 per barrel, you may re-enter again to ride on the long-term fundamental story of crude oil.

Sunday, August 10, 2008

The Art of Selling, Part I

There are countless books written on what to buy. If you go to business school, they will teach you how to value a company, you will have a pretty good idea of what to buy and how much you should be paying for a business. However, there are very little books written about when to sell. I must say, the true art of investing is SELLING!

Selling too early or too late will affect your return dramatically. Amateur tends to sell out too early especially after they hold on to a stock too long. The moment a stock breakout, they will dump share quickly as they are afraid of their profit evaporate very quickly. Unfortunately, after they sold out, the stock will continue to run - 20, 30, 50 even 100% up. They will really kicking themselves........looking back at my own experience, I did commit this kind of silly mistake when I first started investing.

Fortunately, I keep a diary. I reflect and learn pretty quickly not to repeat my mistake. I learn the hard way after forgo almost RM 10,000 profit, I swear I will never again make this mistake -- I tell you the pain was really unbearable, more painful than losing money on bad investment decision.

The pro says you must let your winners run. Agree, the begging question is how long should you let your winners run? How do you know your winners run of gas? Let's take crude oil for example.

By looking at the chart, the run started in 2003 and by 2004, it has taken out the all time high of US $ 40 per barrel. For the sake of the argument, let say you have a position at US $ 40. Will you continue to let it run to US $ 80 / barrel. Will you be selling out when it has a violent correction of 40% in 2006? If you did, you must be regretting because it went straight up to US $ 147? Assuming you have not sold at the top, will you be selling now?

If you were to listen to Jim Roger, the theory seems to be solid, so is his prediction.

When do you abandon your predictions and follow the action of the market?

To be continued ...................

Selling too early or too late will affect your return dramatically. Amateur tends to sell out too early especially after they hold on to a stock too long. The moment a stock breakout, they will dump share quickly as they are afraid of their profit evaporate very quickly. Unfortunately, after they sold out, the stock will continue to run - 20, 30, 50 even 100% up. They will really kicking themselves........looking back at my own experience, I did commit this kind of silly mistake when I first started investing.

Fortunately, I keep a diary. I reflect and learn pretty quickly not to repeat my mistake. I learn the hard way after forgo almost RM 10,000 profit, I swear I will never again make this mistake -- I tell you the pain was really unbearable, more painful than losing money on bad investment decision.

The pro says you must let your winners run. Agree, the begging question is how long should you let your winners run? How do you know your winners run of gas? Let's take crude oil for example.

By looking at the chart, the run started in 2003 and by 2004, it has taken out the all time high of US $ 40 per barrel. For the sake of the argument, let say you have a position at US $ 40. Will you continue to let it run to US $ 80 / barrel. Will you be selling out when it has a violent correction of 40% in 2006? If you did, you must be regretting because it went straight up to US $ 147? Assuming you have not sold at the top, will you be selling now?

If you were to listen to Jim Roger, the theory seems to be solid, so is his prediction.

"The bull market in crude oil started in 1999, and in the last nine-years the oil market has gone down over 40% three times. Was that the end of the bull market?" asked famed investor Jim Rogers on July 29th. In a world of limited resources, the world's population is expected to double over the next 40-years, with more than 95% of the increase in demand concentrated in developing countries.

When do you abandon your predictions and follow the action of the market?

Jesse Livermore, the world's greatest trader used to say, "Remember, the market is designed to fool most of the people most of the time. Sometimes, the market will go contrary to what speculators have predicted. At these times, speculators must abandon their predictions and follow the action of the market. Never argue with the tape. Markets are never wrong, but opinions often are. I only try to react to what the market is telling me by its behavior," he said.

To be continued ...................

Saturday, August 9, 2008

Crude oil entered bear market

Incredible 08-08-08 day. It was supposed to be a very lucky day for the Chinese turned out to be not so lucky as Shanghai Composite Index tumbled by 4.5%. However it was a very lucky day for the Westerner.

Fannie Mae losses came in with a bang, US $ 2.30 billion but that did not rattle the market because investors cheered on the falling crude oil. Crude oil fell 22% from the top which has fallen into a bear market now. Crude oil closed at $ 115.

As a result, equities market closed with a bang, the Dow surged 300 points(11,734), or 2.7%. The Dow Jones Transportation jumped even more spectacularly, 4% up. Nice. It is time to short commodity and long on consumer and transportation stocks.

I think the last excuse for sellers will be growth, at some point, when the market have sufficient catalyst to price in recovery -- that is will be a bigger bang for equities market. ECB hold off their rate hike as I think they perceived their economy is much weaker than they thought. Central banks around the world start to cut rates will be next big thing to watch for the next 3 - 6 months.

Fannie Mae losses came in with a bang, US $ 2.30 billion but that did not rattle the market because investors cheered on the falling crude oil. Crude oil fell 22% from the top which has fallen into a bear market now. Crude oil closed at $ 115.

As a result, equities market closed with a bang, the Dow surged 300 points(11,734), or 2.7%. The Dow Jones Transportation jumped even more spectacularly, 4% up. Nice. It is time to short commodity and long on consumer and transportation stocks.

I think the last excuse for sellers will be growth, at some point, when the market have sufficient catalyst to price in recovery -- that is will be a bigger bang for equities market. ECB hold off their rate hike as I think they perceived their economy is much weaker than they thought. Central banks around the world start to cut rates will be next big thing to watch for the next 3 - 6 months.

Friday, August 8, 2008

8-8-08, The Olympic Economy

Today is a glorious day for China. Once labeled as the Sick man of Asia will showcase their economic success to the world.

(WSJ)Never in the history of sports has so much money been spent in 15 days. The $43 billion official bill for this month's Beijing Games is one-and-a-half times bigger than the previous five Olympics' bills added together. It works out at $2.9 billion per day, or $140 million per event.

Many will begin to worry post-Olympic, will China escape post-Olympic curse, the economy will slowdown drastically? Not really in my opinion.

To understand why, think about that $43 billion in context. Official investment spending in China in 2007 totaled $1.6 trillion. So assuming Olympic investment spending was spread out over three years, it hardly reaches 1% of annual investment spending. Many of the projects, like the metro, were needed anyway -- and that will remain the case in 2009 and beyond, as more work is done in Beijing and other cities, as well as in the countryside, to build out the railway infrastructure and the suburbs, the new locus of economic growth.

Much the same can be said about the Olympics' effect on consumption. Beijing expects around 500,000 visitors, roughly equivalent to the total number of tourists who visited Sydney for the 2004 summer Games. But again, that figure pales in contrast to the 11.6 million documented visitors China hosted in August last year -- without the attraction of the Olympics. Given restrictions on visas in recent months, it is not clear if total visitor numbers will even rise this summer as a result of the Games.

* * *

The State Council last week restated its commitment to combating inflation. That means that most of the controls on bank lending will likely stay in place for a while, causing continued pain for a large chunk of corporate China. And it has made a lot of folks nervous that the tightening policies rolled out in October last year are now overstaying their welcome, particularly as the global economy slips. By the end of the year, Beijing will be looking to make monetary policy more stimulative. They already seem to have decided to slow down yuan appreciation.

Compared to the rest of Asia, China isn't as vulnerable to a global economic slowdown. According to European Central Bank research, some 70% of mainland China's demand comes from domestic sources. That compares with 65% domestic demand in Korea, 54% in Thailand, 49% in Taiwan, and 31% in Malaysia. Only Japan and Indonesia are less vulnerable to a collapse in external demand.

Still, exports have powered a good chunk of China's double-digit growth in recent years. Last year, net exports composed 16.3% of GDP and 2.5 percentage points of GDP growth. That figure is somewhat misleading, given that China adds roughly 50% of value to its exports through processing. If export growth fell to 7% year-on-year in 2008 from 21% last year, as we forecast, China's economy would lose two to two-and-a-half percentage points of growth. Then there are the second-round effects of an export slowdown on investment and consumption. Some 20% of investment, which makes up 40% of GDP, is export-related.

China's economy isn't on the brink of collapse. The economy will likely expand by more than 8% next year, and employment will continue to rise. If the global slowdown takes a turn for the worse, Beijing could launch a fiscal stimulus package, cut interest rates and encourage banks to lend. That said, no one really knows what two or three years of much slower global growth would mean for China. And there is clearly a rising risk of mismanaging policy in this more challenging environment.

None of this hinges on the Olympics. The Games may have sped up infrastructure spending and given a temporary boost to Beijing's bottom line, but that will be it, as far as the economics go. The challenge for China's economy comes from other quarters. The Olympics is the least of their worries.

There could be slowdown but no disaster.

Thursday, August 7, 2008

M'sia 'attractive' but..........

With Oil and Gas and Plantation sectors retreated from its all time high, compounded by political uncertainties, what is there for Bursa Malaysia? If plantation were to correct by 40-50% and stay low for next 1 - 2 years, this will reduce KLCI index target by 8 - 10%, meaning KLCI new target could be in the range of 1170 - 1280 instead of 1300 to 1400.

What happened to Bursa Malaysia is nothing unique. We are entering a very bearish moods around the world. Worldwide equities are cheap by historical standards 10-12 times trailing-PE. However we must find out whether corporate earnings have hit the peak? Take some of the banks in Hong Kong for examples:

Repricing of Bank of East Asia will be around HK $ 31 not HK $ 50 - HK $ 60. A new anchor required.

Berkshire generated 4-5% in 1973 - 1974 bear market while S & P declined between 15 to 26%. However, S & P YoY change in 1975 and 1976 was 37% and 24%. Those bought in 1973 - 1974 were rewarded handsomely provided bought around bottom, 30-40% declined from the top.

So, let's wait a little more patiently.

A recent Merrill Lynch fund manager survey on global emerging markets found that more fund managers had an 'underweight' stance on Malaysia last month (56) compared to April (44).

In the same period, the number of those holding 'overweight' positions fell to 13 from 22.

According to stock exchange operator Bursa Malaysia Bhd, foreign investors accounted for about 42 per cent of trading value in the market in the first half of the year, compared with 37 per cent in the whole of 2007.

But in terms of foreign ownership, it was in the 'low 20s per cent', compared to the 'mid to high 20s per cent' last year, Bursa Malaysia chief executive officer Yusli Mohamed Yusoff had said.

What happened to Bursa Malaysia is nothing unique. We are entering a very bearish moods around the world. Worldwide equities are cheap by historical standards 10-12 times trailing-PE. However we must find out whether corporate earnings have hit the peak? Take some of the banks in Hong Kong for examples:

(The Standard Finance) Bank of East Asia (0023) yesterday announced its first year-on-year drop in interim net profit since 2002, posting a decline of 52.4 percent on the back of collateralized debt obligation and structured investment vehicle writedowns.

Net profit in the six months ended June 30 had been expected by analysts to fall by only 13 to 20 percent. Instead, the bank reported an interim net profit of HK$894 million, compared to HK$1.877 billion the previous year.

Repricing of Bank of East Asia will be around HK $ 31 not HK $ 50 - HK $ 60. A new anchor required.

(WSJ)HSBC has allocated plenty of capital to Asian markets, including China and India. The long-term economic outlook is good. But as the sharp declines on Asian stock markets have shown this year, there could be hiccups along the way.

Meanwhile, HSBC's return on assets has fallen recently in Hong Kong. In the rest of Asia Pacific, its first-half return fell to 1.4% from 1.7% a year earlier.

These disappointing returns have proved a drag on HSBC's overall performance. And the self-styled "world's local bank" remains weak in some regions where growth is fast.

Berkshire generated 4-5% in 1973 - 1974 bear market while S & P declined between 15 to 26%. However, S & P YoY change in 1975 and 1976 was 37% and 24%. Those bought in 1973 - 1974 were rewarded handsomely provided bought around bottom, 30-40% declined from the top.

So, let's wait a little more patiently.

Investing for Beginners

When I first started blogging, I thought of documenting my thoughts and hoping to bless others along the way. I've great empathy for small investors(myself included) as we are trying to grow our wealth. We can either let professional manage our money or DIY. Many of us are very skeptical of trusting professional fund managers as it is the only job in the world they get paid when they lose clients' money.

DIY has its own problems as many lack of knowledge. Those with some knowledge but may not have emotional control or money management discipline. If any of you lack of knowledge and really thinking of improving yourself, you can visit these three sites. I hope it can help you. I don't intend to reinvent the wheel by posting basic investing as these guys did a good job.

Advance readers may leave your recommendations if you come across any good sites.

http://beginnersinvest.about.com/cs/investinglessons/l/blintroduction.htm

http://mystockthoughts.blogspot.com/2007/08/financial-statement-as-analysis.html

http://www.investopedia.com/university/

Good Luck.

DIY has its own problems as many lack of knowledge. Those with some knowledge but may not have emotional control or money management discipline. If any of you lack of knowledge and really thinking of improving yourself, you can visit these three sites. I hope it can help you. I don't intend to reinvent the wheel by posting basic investing as these guys did a good job.

Advance readers may leave your recommendations if you come across any good sites.

http://beginnersinvest.about.com/cs/investinglessons/l/blintroduction.htm

http://mystockthoughts.blogspot.com/2007/08/financial-statement-as-analysis.html

http://www.investopedia.com/university/

Good Luck.

Wednesday, August 6, 2008

Ah, Oil Story again

Real quick as I'm on the road again. Traveling around Bangkok for last few days. A new business is mushrooming all over Bangkok. Workshop converters banners to NGV and LPG are all over the places. Talked to an old friend, converter his BMW to NGV two years ago. You can really see the consumption habits change even those are loaded. Will catch up soon. Crude oil broke below 120 is a good sign for consumers and airlines but bad news to economy. CNN has a story.

Americans are driving 4% less now than they were a year ago, Rosenberg writes, while energy use in inflation-adjusted terms has dropped 2% - an event he calls "extremely rare."

Tuesday, August 5, 2008

Rubber Glove Industry, Part II

The rubber glove makers share price plunged by almost 30-50% as investors worried of

(i) skyrocketed latex price. Latex price increased by almost 200% from 2002 to 2007.